Editor’s note:

This bill was withdrawn on 1 September 2022.

The bill was reintroduced as the

Taxation (Annual Rates for 2022–23, Platform Economy, and Remedial Matters) Bill (No 2) 164-1 (2022), Government Bill Contents – New Zealand Legislation on 8 September 2022

The remedial matters in the Taxation (Annual Rates for 2022–23, Platform Economy, and Remedial Matters) Bill introduced into Parliament 30 August 2022 and withdrawn on 1 September are now included in the The Taxation (Annual Rates for 2022–23, Platform Economy, and Remedial Matters) Bill (No2). These include:

- an amendment to clarify the provisions of the Income Tax Act 2007 that exempt inherited residential land from the bright-line test

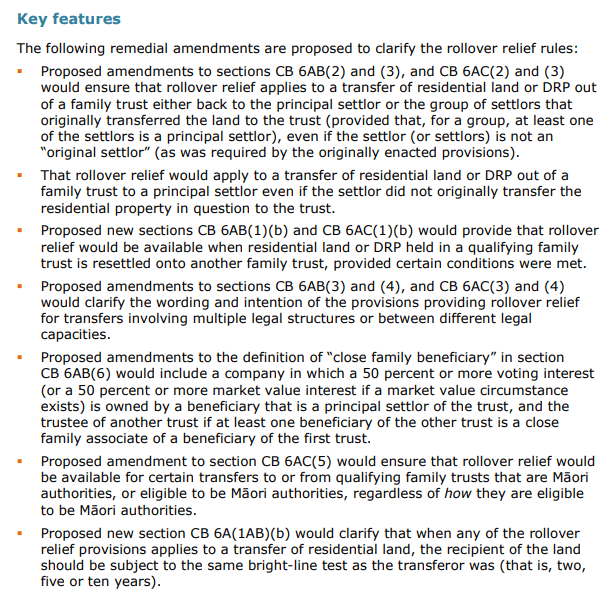

- amendments to allow rollover relief in respect of certain interest deductions in relation to specified transfers to or from family trusts

- amendments to allow rollover relief in respect of the bright-line test in relation to specified transfers to or from family trusts including resettlements

The Bill contains a range of proposed improvements and maintenance measures to ensure the smooth functioning of the tax system. Measures that relate to trusts include:

- amended definition of principal settlor and settlement for the for the bright-line test and and the interest limitation rules

- A new definition of a “foreign exemption trust”. A foreign exemption trust would include any trust that is currently a foreign trust, but it would also include trusts where a trustee makes use of the foreign sourced income exemption under section HC 26 of the Income Tax Act unless there is an election under section HC 33 in effect

- an explicit power for the Commissioner of Inland Revenue to deregister a trust if the trust does not meet the requirements for registration under section 59B of the Tax Administration Act 1994. This power would be exercised on the Commissioner’s own initiative or on application by the trust

- extend the requirement for the contact trustee to provide a signed declaration for each settlor of a trust on registration to also require a signed declaration for persons who become a settlor after registration

- clarify that residual (final) beneficiaries are subject to the same disclosure requirements as discretionary beneficiaries.

- a requirement that contact trustees update information provided in an annual return if it changes. Changes to trustees or contact details would have to be updated within 30 days of the contact trustee becoming aware of it. Changes to other information would have to be updated in the next annual return at the latest.

- a new discretion for the Commissioner of Inland Revenue to backdate a foreign trust’s registration where a trustee has made reasonable efforts to be registered on time.

- replacing certain references in the Tax Administration Act 1994 to beneficiaries of a “fixed trust” or “discretionary trust” with references to beneficiaries with fixed or discretionary interests in a trust

- replacing the confusing, undefined references to trustees “in the business of providing trustee services” in the Tax Administration Act with the broadly similar, existing define term of “professional trustee”

- a proposed amendments will treat a will creating a trust as a trust deed for the purposes of the foreign-sourced income exemption.

References:

For more information, see the Bill, the Bill commentary, the departmental disclosure statement, and the regulatory impact assessments.

Discussion

No comments yet.