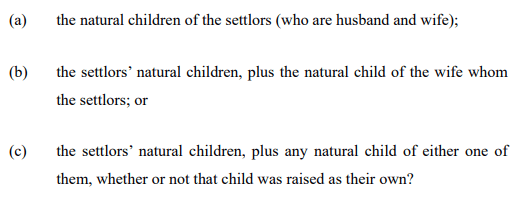

Merona Trustees Limited considers how the words “the children of the settlors” should be interpreted. To resolve the dispute as to whether these words mean:

the trustees have sought directions pursuant to section 133 of the Trusts Act.

Background facts

- Merv and Rona married in 1958

- Rona had two children from a previous marriage, Rob and Ray

- Rob and Ray were raised respectively by Rona’s mother and aunt following the break-down of Rona’s marriage as there was no financial support available to her to raise the children alone

- Following Rona’s marriage to Merv, Rob lived with Merv and Rona

- Rob did not know he had a brother (Ray). As noted at [6] “… It is uncertain whether this was because she was told she must sever contact with him if her aunt took over his care, or because it was simply too painful for her to do so.”

- Merv and Rona had two children: Lilly and Miffy

- Rob, Lilly and Miffy were raised as a family unit and Lilly and Miffy were not toldthat Rob had a different father

- Ray was not adopted by his aunt Edna and only found out that Edna’s husband Maurice who he thought was his father, was not his father when he was planning to marry his now wife Helen and Maurice told him that he would need to use his birth name

- Rob discovered that he had a brother when he was 32. A proposal that they meet was rejected by Rob. Ten years later Rob’s wife Sue contacted Helen to arrange a meeting. However, by this stage Ray was more ambivalent about doing so and no meeting occurred then

- Six weeks later, following a chance encounter Rob and Ray met and maintained a relationship for 20 years until a falling out a the end of a canal boat holiday in France in 2010

- Several months after Rob and Ray met Rob told Rona about the meeting. This was a huge shock to Rona, who by then was in her early sixties.

- Rona eventually met with Ray in around 1993 and there was regular family contact until 2010 when there was a falling out between Lilly and Miffy

- Merv and Rona settled the M & R Cooper Trust (the No. 1 Trust) in 1986. The beneficiaries of The No. 1 Trust included “the children of the said Mervyn Nathaniel Cooper of Christchurch, Company Director and Sylvia Rona Lorraine Cooper, his wife born before the date of distribution”.

- The No. 1 Trust owned land and buildings in Riccarton where Merv established the Kauri Lodge Retirement Village, which was subsequently sold for $3,500,000

- The Hempleman Trust was settled on 27 April 2002 to own holiday homes on Hempleman Drive, Akaroa

- Following legal advice in November 2008 the No. 1 Trust and the Hempleman Trust were resettled onto the M and R Cooper No. 2 Trust (the No. 2 Trust)

- Soon after the resettlement, Merv and Rona signed a memorandum of guidance, which amongst other things set out their wish regarding making equal distributions of income to “such of our three children Robert William Cooper, Lilly Jessica Cooper and Amanda Jane Cooper-Davies as continue to survive us” as well as smaller distributions to the children and grandchildren of those three children

- In late 2009, Merv and Rona went to their lawyers to prepare Rona’s will. At this meeting, Rona told her lawyer about Ray and described him as her “birth son”. In her will, Rona left a gift of $50,000 to each of Rob, Lilly and Miffy who she referred to as “my children” and $50,000 to Ray, referring to him as her “birth son”

- Rona left a letter to Ray with her will explaining the circumstances of his being raised by her sister

- Rona died in 2013

Opinions

A number of opinions were subsequently obtained regarding the position of Rob and later Ray as discretionary beneficiaries.

- In an opinion dated April 2016 Duncan Cotterill questioned whether Rob was a discretionary beneficiary as one of the “children of the settlors.” This was expressed as “preliminary view”, but was described as “retrievable” as Rob could be appointed as an additional discretionary beneficiary

- In June 2016 Harmans were of the view that Rob was included within the definition of discretionary beneficiaries but, like Duncan Cotterill, said that any doubt could be cured by appointing him as a discretionary beneficiary. Shortly afterwards, a deed of variation dated 9 June 2016 was executed, appointing Rob, his children, and his grandchildren as discretionary beneficiaries

- Subsequently Katherine Ewer was engaged by the trustees of the No. 2 Trust to review the advice regarding the discretionary beneficiaries. Hew opinion was that:

- Following Merv’s death in 2020 Greg Kelly Law gave advice that Rob was likely a discretionary beneficiary but not a final beneficiary and Ray’s status was likely the same.

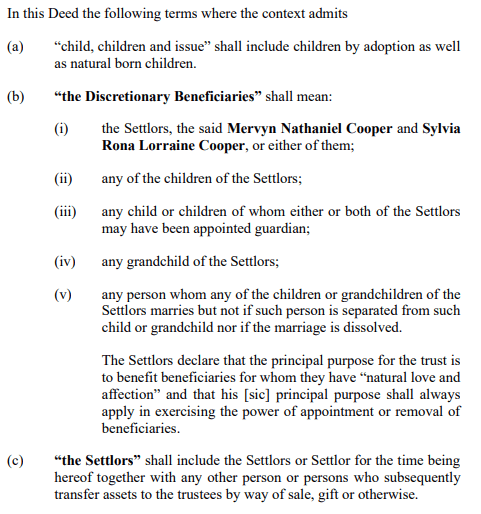

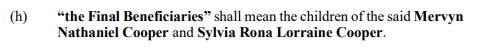

Terms of the trust

Before considering the issues arising, the court identified the need to set out the relevant provisions of the trust deed for the No. 2 Trust, which are:

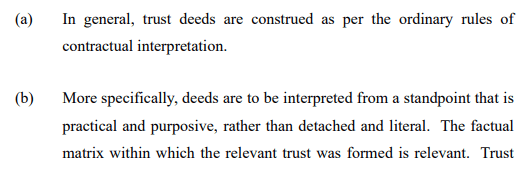

Trust deeds are generally interpreted the same way as wills and contracts. The relevant principles as set out in Holland v Jonkers are as follows:

The application of the principles of contractual interpretation applying to wills and trusts was confirmed by the Court of Appeal in Powell v Powell. Section 70 of the Property Law Act 1952 also assists, this section providing that:

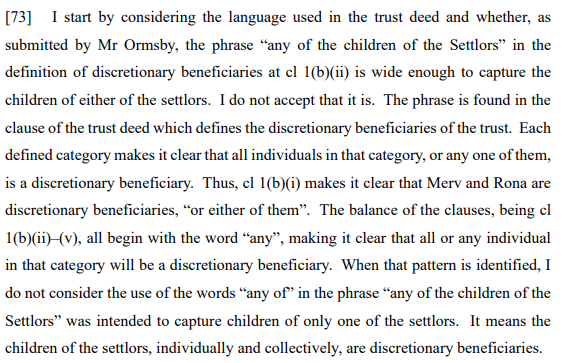

The Court’s approach to the matter was to consider the language of the trust deed, but also to take context and subsequent conduct into effect as set out in the following paragraphs from the judgment:

The memoranda of guidance were particularly important aspects of subsequent conduct considered by the court. As stated at [81]:

While subsequent conduct will not always be admissible, the admissibility of subsequent conduct in accordance with the test of relevance when construing a trust deed was confirmed in Edge v Bourke.

As set out at [84] to [86]:

In conclusion the court was satisfied that “notwithstanding the literal meaning of the trust deed, which would suggest that only the natural children of both Rona and Merv were intended, when the trust deed provisions are interpreted objectively and in light of what the trust deed would have conveyed to a reasonable person having all the background knowledge reasonably available to the parties at the time it was executed, the words “the children of the Settlors” must be expanded to include the children who were considered part of the settlors’ family unit at the time. In other words, it includes not just the natural children of their marriage, but also the child they brought up within their family unit as if he was the natural child of both of them.”

The court stated that the conclusion would be disappointing to Ray. Although he did reunite with his mother that did not “alter the fact that at the time the trust deed was entered into, a reasonable person would distinguish between Ray, who was not brought up as the child of Merv and Rona, and the three children who were.”

Editor’s note

The importance of the role of the memorandum of guidance as permissible subsequent conduct will be further considered by Vicki Ammundsen in the Trust Series 2022 – Memoranda of Wishes webinar held on 7 September 2022. Register with CCH Learning.

References:

- Merona Trustees Limited [2022] NZHC 1971

- Trusts Act 2019, section 133

- Holland v Jonkers [2021] NZHC 3469 at [109]

- Powell v Powell [2015] NZCA 133, [2015] NZAR 1886 at [53]

- Edge v Bourke [2020] NZHC 1185, [2020] 3 NZLR 522

Discussion

No comments yet.