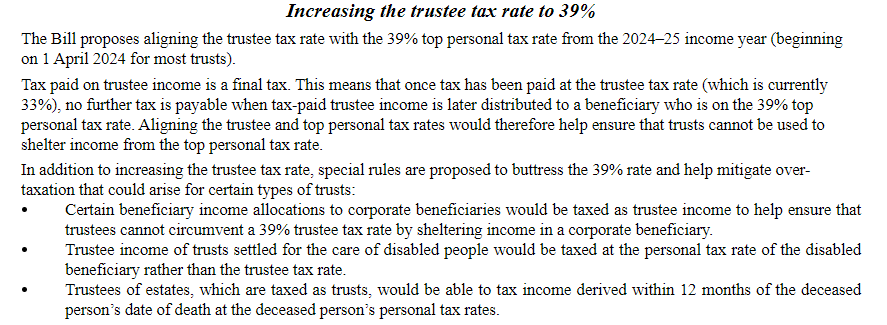

The Government has announced its intention to align the trustee tax rate with the 39% top personal rate effective 1 April 2024. A limited exemption is proposed for deceased estates.

The following commentary from the Taxation (Annual Rates for 2023–24, Multinational Tax, and Remedial Matters) Bill also explains the proposed exemption for trusts settled for the care of disabled people:

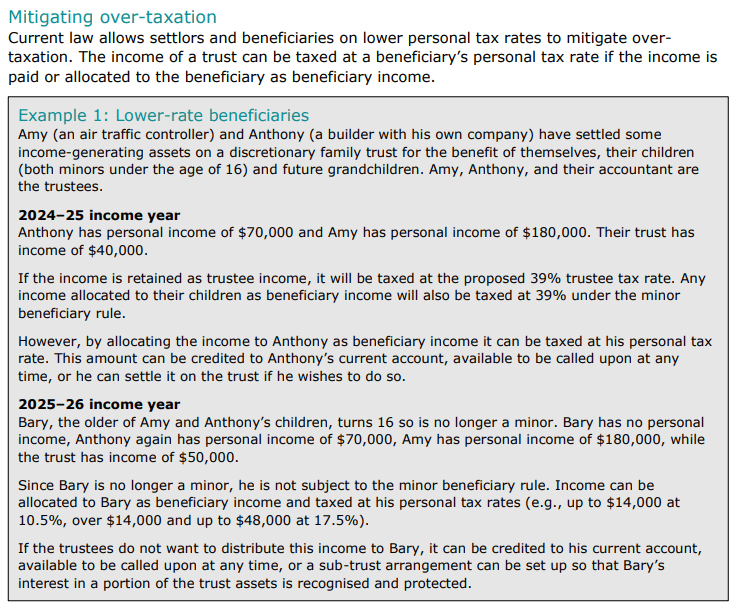

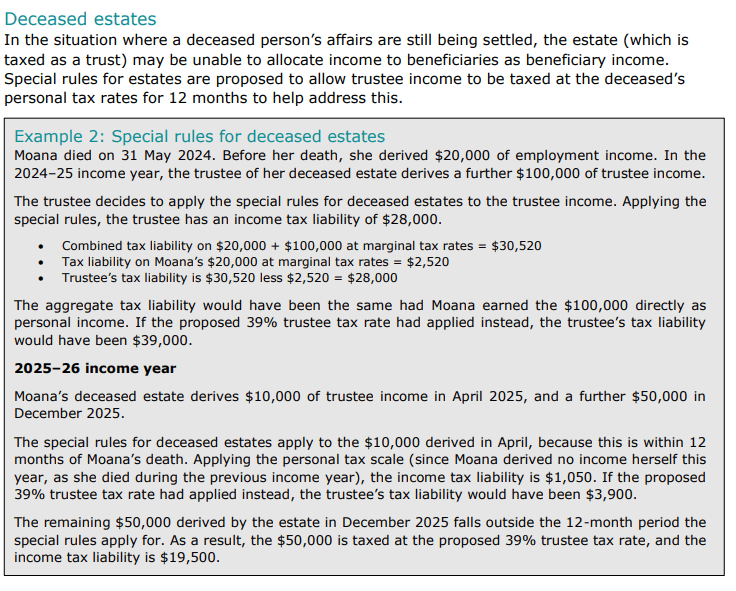

The following examples are set out in the Inland Revenue fact sheet “Increasing the trustee tax rate to 39%.”

Editor’s note:

On 1 June 2023 Inland Revenue advised that:

We are also aware that one of the examples used in the Bill commentary and factsheet has caused some confusion. The example noted that trustees could distribute income to a beneficiary, who may then decide to resettle it on the trust. We agree that there is some uncertainty under existing law about the tax treatment of such a settlement and we will be undertaking consultation on this. To avoid creating that doubt we have changed the example in those documents.

Also see IRD guidance on trust tax tweaked over concern it was promoting tax avoidance.

References:

- fact sheet on the trustee change

- Taxation (Annual Rates for 2023–24, Multinational Tax, and Remedial Matters) Bill

- The Minister’s press release

- Bill commentary, and

- other supporting information.

Discussion

No comments yet.