The liquidation of Cryptopia Limited, which rana cryptocurrency exchange, is complex and involves “… complex arrangements regarding around 370 functioning cryptocurrencies owned by some 960,000 holders of accounts with positive balances in around 180 countries.”

Cryptocurrency is property that can be held by a trust. See Can’t see it, cant’s touch it, can’t explain it.

There have been a number of proceedings relating to practical aspects of the Cryptopia’s liquidation. Houchens v Ruscoe and Moore relates to an application to, amongst other things, appoint a special trust adviser. The application is novel and without precedent.

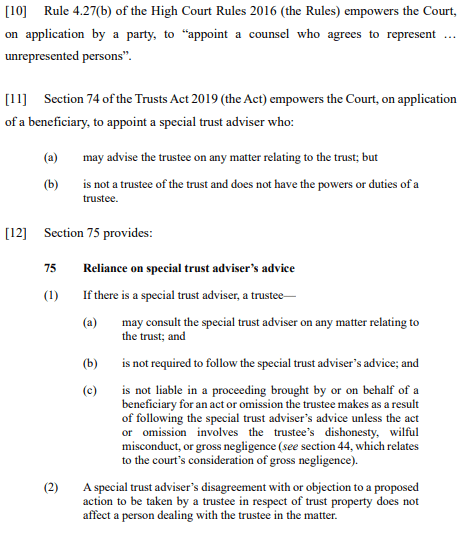

The relevant law is set out at [10] to [12] of Houchens v Ruscoe and Moore as follows:

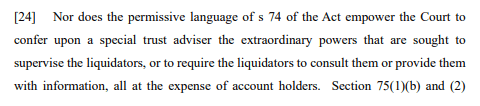

The court’s view of the application, which was not granted, is set out at [24] and [25] as follows:

Editor’s note: while the application made was not granted in this case, it is helpful to see judicial consideration regarding the scope of this creature of statute.

The subsequent costs decision reflected the novel application, procedural deficiencies and additional costs the application occasioned for the liquidators. The application for indemnity costs ($85,561) was declined and costs were awarded on a 2B basis with a 25% uplift ($16,879.38 plus disbursements).

Also see the subsequent decision in Ruscoe v Houchens regarding Epic Trust Limited’s application to appear in the proceedings and make submissions. As noted at [17](a) of that judgment: “The only point of his submissions is about the duty to account. Mr Cattermole’s evidence is that the purpose is to ensure the beneficiaries have the appropriate information as to the state of the coins held in the trusts.”

References:

- Houchens v Ruscoe and Moore [2023] NZHC 2969

- Ruscoe v Houchens [2023] NZHC 3224

- Ruscoe v Cryptopia Limited (In Liquidation) [2020] NZHC 728

- Houchens v Ruscoe and Moore (Costs) [2023] NZHC 3427

Discussion

No comments yet.