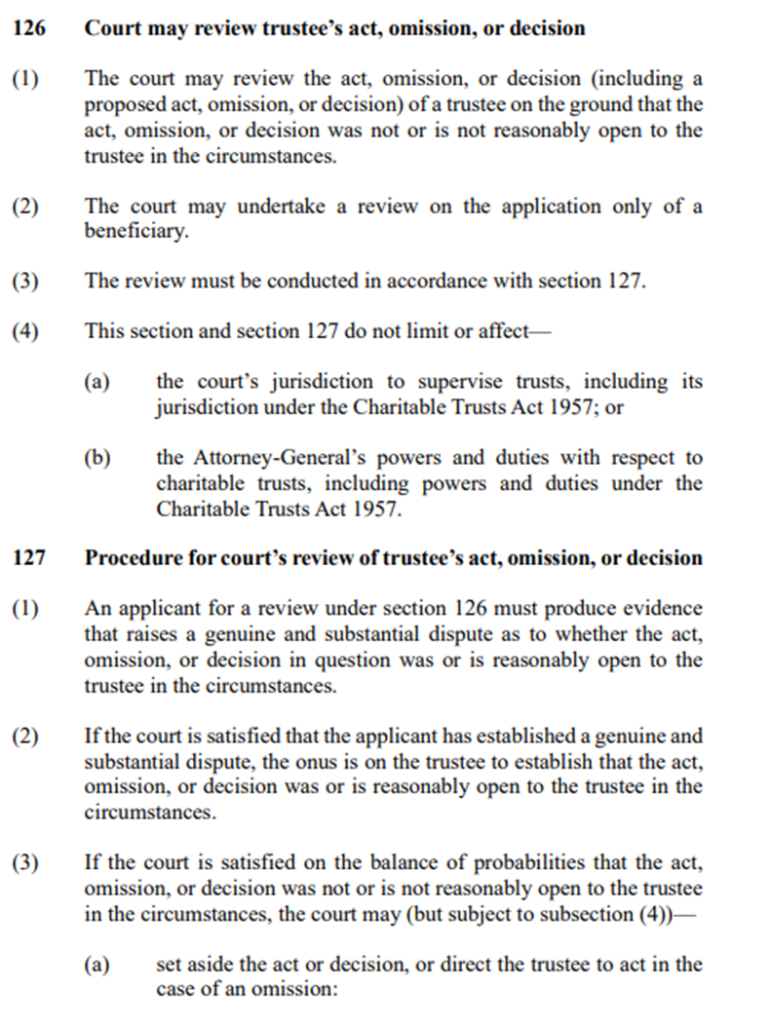

Sections 126 and 127 of the Trusts Act provide for the review of trustee decisions. The scope and relevant procedure are as follows:

As noted by Churchman J in Paton v Acropolis Holdings Limited[1]at [54] the review of a trustee decision is a two stage process:

- first the beneficiary must produce evidence that establishes a genuine and substantial dispute as to whether the decision was reasonably open to the trustee, and

- second (if the first stage is met) the trustee must then establish (on the balance of probabilities) that the decision was reasonably open to the trustee.

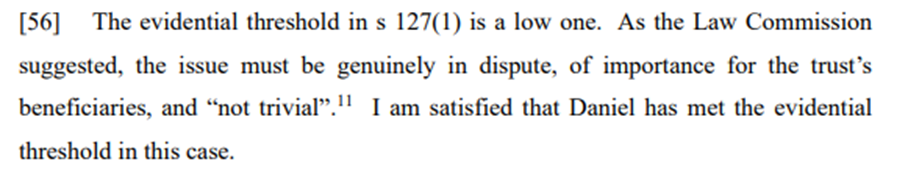

As noted in Paton v Acropolis Holdings Limited at [56]:

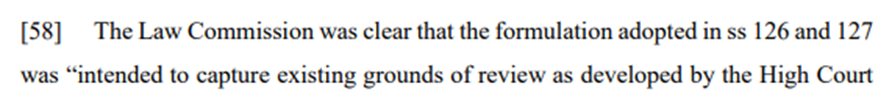

The task for the Court then is to determine whether the evidence provided by the trustees demonstrates that the decision that has been challenged was a decision that the trustee could reasonably make in the relevant circumstances. In Paton v Acropolis Holdings Limited, which relates to the challenge of a decision where the trustees made a decision to distribute approximately $4.2 million to one grandchild and $214,000 to each of the other two grandchildren, the Court sets out the relevant considerations at [58 to [60] as follows:

In Paton v Acropolis Holdings Limited the arguments put forward were set out at [67] to [70] as follows:

In analysing this the Court made the following observations:

- the terms of the trust provide the starting point for the analysis of trustee conduct

- memoranda of wishes are, nevertheless, an “expression of desire rather than obligation. With respect to the subsequent memorandum of wishes Churchman J noted as follows at [80]: “… The trustees clearly have had regard to this charge by altering the proposed distribution of the 1/7th share. Daniel may disagree with the distribution proposed (and the question in that case is whether the proposed distribution is one which a reasonable body of trustees might reasonably have come to), but it is clear that the trustees have had regard to the amended wording in altering the proposed distribution in order to provide the later-born grandchildren Louis and Thomas each with a share. As has been noted, the trustees’ evidence is that they were “acutely aware of Bob’s expression of wishes”. It is not in dispute that the trustees have altered their position on the appropriate distribution of the 1/7th share following the birth of firstly Louis and then again following the birth of Thomas. Daniel’s challenge is rather to the adequacy of the alteration in the position…”

- notwithstanding the trustees’ communication regarding their intention to distribute a significant portion of the 1/7th share to Raven the trustees “… are entitled — and indeed must —exercise their decision-making duties unfettered as trustees.”

- the trustees modified their position with respect to the distribution to Raven following the birth of the subsequent grandchildren confirming that the trustees had not fettered their position

- trustees are required to be even-handed and impartial between beneficiaries. However, the duty of impartiality does not require equal treatment or equality in distributions. A decision to not make an equal distribution does not mean that trustees have failed to be impartial as between the different beneficiaries

- whether a decision is unreasonable or perverse does not invite a moral judgment, rather the question for the court is “whether the decision or proposed decision is perverse, capricious or irrational, or in other words so unreasonable that it is “a decision that no reasonable trustee could have made.” As noted at [95]:

Had the Court found that the proposed distributions were ultra vires or unreasonable, which it did not, it would be “wholly inappropriate” in a case such as Paton v Acropolis Holdings Limited for the Court to direct specific distributions, rather the correct course of action would be to “direct the trustees to reconsider the decisions according to [the Court’s] findings in [the] judgment.

Also see: Why the courts have limited power to make decisions about trust assets.

For an up-date on drafting memoranda of wishes see Trust Series 2024 – Drafting Guidelines for Memoranda of Wishes

References:

- Paton v Acropolis Holdings [2024] NZHC 43

- Andrew Butler “Trustees and Beneficiaries” in Andrew Butler (ed) Equity and Trusts in New Zealand (2nd ed, Thomson Reuters, Wellington, 2009) 105 at [5.1.2]–[5.1.3]; Re McCaw Lewis Trustees (No 4) Ltd [2014] NZHC 2627 at [19]; Bulley v Attorney-General [2012] NZHC 615 at [47]–[53]; and Pryor v Bulley [2013] NZCA 559, [2015] NZAR 518 at [12].

- Kain v Public Trust [2021] NZCA 685 at [116]

- Trusts Act, section 35

- Te Aka Matua o te Ture | Law Commission Review of the Law of Trusts: A Trusts Act for New Zealand (NZLC R130, 2013) at [11.10]

- Masters v Stewart & Ors [2014] NZHC 2419

Discussion

No comments yet.