Sherwin v JKA Holdings Limited & Ors relates to the Douglas Hilton Family Trust (the Trust), which was settled in 1985 by Dr Douglas Sherwin’s mother on terms that infer that Dr Sherwin, who was the source of the trust’s economic wealth, was the true settlor. This is addressed by Becroft J at [15] as follows:

The Trust’s date of final distribution is the 20th anniversary of Dr Sherwin’s death. Dr Sherwin died in 2006. Dr Sherwin was survived by five children, left half of his estate to his son Wayne who has special needs, with the balance to be divided amongst his other children.

The Trust is discretionary prior to vesting. As noted at [3]:

By way of background, as noted at [9] to [13]:

The matter came before the court pursuant to an application for orders terminating the Trust pursuant to section 124 of the Trusts Act (copied below). This was problematic as while section 124 of the Trusts Act “allows a court to act in a protective way on behalf of … the three types of beneficiaries described in s 124(2)(a)–(c) … counsel agreed that none of those three categories applied to any of the five siblings.”

It was ultimately agreed that the application should progress as an application to review the trustees’ proposal for a final distribution of the Trust’s assets pursuant to section 126 of the Trusts Act (also copied below).

Section 127 of the Trusts Act (copied below) sets out the procedure to review a trustee decision. As set out at [36] to [39]:

See Two step process to review trustee decision for further consideration of the interplay between sections 126 and 127 of the Trusts Act.

Importantly, as confirmed by Becroft J at [43] the court’s powers pursuant to section 127 do not extend to substituting the court’s decision for that of the trustees, Becroft J stating that “I am in absolutely no position to do that. I have no accounting or other evidence as to how the funds could or should be distributed unequally. That would be a matter for the trustees, should the issue arise.”

In considering whether the trustees’ proposed distribution can proceed, which was essentially dispositive of the matter, the following points were made by Becroft J:

- as early as 2013 the trustees signaled a rebalancing as part of a final distribution

- such rebalancing was standard practice, and was consistent with clause 2 of the trust deed

- the director of the trustee company who was cross-examined extensively regarding the trustees’ proposed course of action was considered by Becroft J to be “as considered, thoughtful and reasoned”. Accordingly Becroft J was of the view that it “… could not be said that the trustees were acting capriciously or had failed to take into account relevant considerations in reaching their decision.”

- it was well open to the trustees to differentiate between the terms of the will and “quite separate” trust. As noted at [48]: “I consider that it is quite reasonable for the trustees to administer the trust separately from the will. There is no necessity for the trustees to take into account Wayne’s actual entitlement under the will and no requirement for them to factor that into their distributions under the trust. Whatever Wayne might think as to his father’s intentions regarding all his assets, Dr Sherwin left no memorandum or parallel instructions regarding the trust. There was also absolutely no suggestion by Dr Sherwin that the trust should be distributed in the same way and on the same basis as the will, or that the trust should be applied in the “spirit” of the will.

- the trustees could have decided to do more to assist the protagonist beneficiary and to accede to his wishes. That said, the decision not to was “well reasoned and considered and certainly well within the terms of the trust deed and their own complete discretion in light of what they know about all the siblings”. As stated by Becroft J at [49] “… Putting the question another way “was it reasonably open to them not to do more for Wayne in all the circumstances?” In my view it certainly was.”

125 application

It was also put to the court that of the court upheld the trustees’ decision, the court could also approve the termination of the Trust.

Becroft J was of the view that there was no useful purpose to do so, making the following practical observations at [53] and [55] to [59] :

…

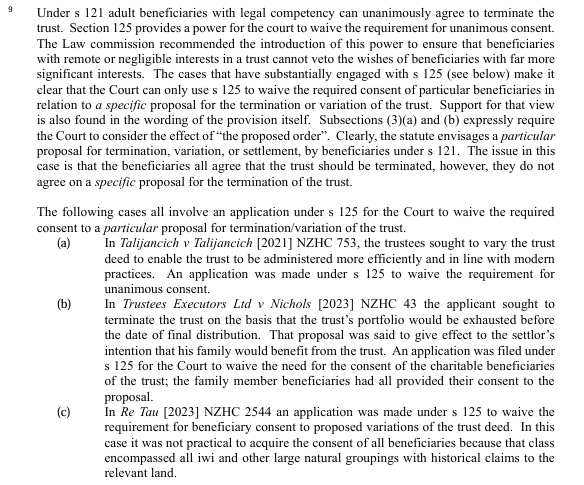

Footnote 9, referred to above is copied below for further guidance:

Result

References

- Sherwin v JKA Holdings Limited & Ors [2024] NZHC 920

- Paton v Acropolis Holdings [2024] NZHC 43

- Te Aka Matua o te Ture | Law Commission Review of the Law of Trusts: A Trusts Act for New Zealand (NZLC R130, 2013) at [11.10]

Legislation

Discussion

No comments yet.