Hooper v Thackwell came before the court by way of a formal proof hearing with respect to a claim brought by her daughter Karen. The background facts are not complex, but raise some complex questions, in particular whether a lawyer could ever rely on a waiver to act on both sides of a transaction that has the effect of transferring the entirety of an elderly client’s wealth to her son.

The history of the matter goes back to October 2014 when Enid Thackwell, then aged 87 and recently widowed:

- sold her home to her son Darryl

- made a will leaving her entire residual estate to Darryl, who was named as her executor and trustee, and

- signed enduring powers of attorny in favour of Darryl as to her personal care and welfare

The following month the sale of the home was completed. A deed of acknowledgment of debt recorded that Enid had loaned the entire purchase price to Darryl. The same day Enid forgave the debt owing to her.

Importantly, the lawyer who acted on the transaction was not Enid’s family solicitor who declined to act on the matter as he was not able to meet with Enid without Darryl being present and who could not as noted at [36] “… provide her with independent advice [or]… have a proper discussion with her on her own.”

With respect to the lawyer who acted on the transaction as noted at [41]:

“Mr Davies’ files dealing with the [documents entered into] were obtained. There is one file note dated 9 October 2014 which is the same day the documents were executed but, although other file note/s recede this file note, the file note appears to record something handwritten about the powers of attorney. What is written is impossible to decipher. There is no record of:

(a) what information (if any) was provided to Mr Davies about the family and the family dynamics;

(b) whether Enid’s rights and responsibilities in relation to both her children were explained to her and, if they were, why she chose to exclude Karen from her Will;

(c) the evidential basis for the certificate as to Enid’s capacity; and

(d) what documents Mr Davies was provided with from the deeds uplifted from Mr Doody by Darryl and Enid.”

Early in 2015 Enid scored 17/30 on a MoCA test. By 2016, Enid had advanced dementia.

Evidence was given of Darryl obstructing contact between Enid and Karen. Documented concerns about Daryl’s care of his mother are set out at [64] as follows:

Whether the claim was out of time was a live issue in the matter. As noted at [66] to [68]:

With respect to whether Enid’s will was invalid due to lack of capacity, after referencing the relevant authorities and evidence before the Court the conclusion reached in the information vacuum presented to the Court is set out at [83] to [86]:

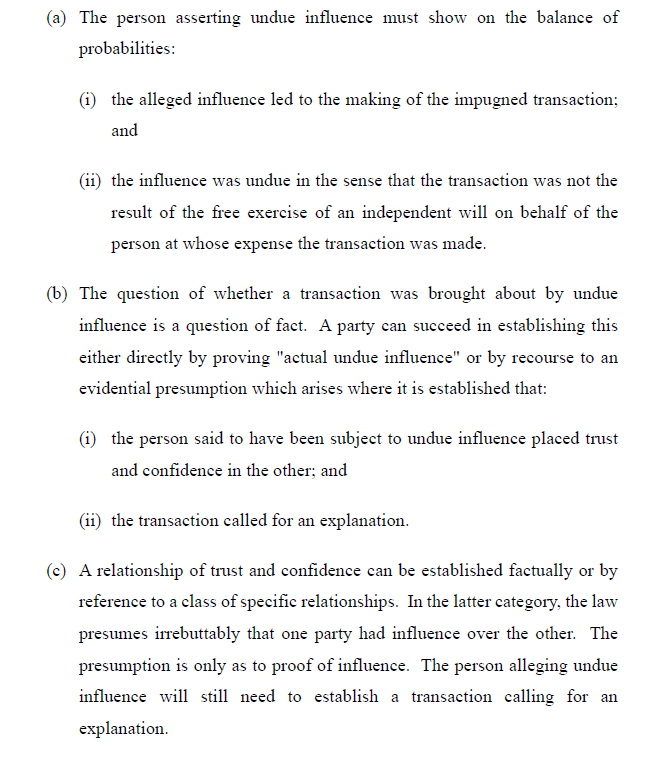

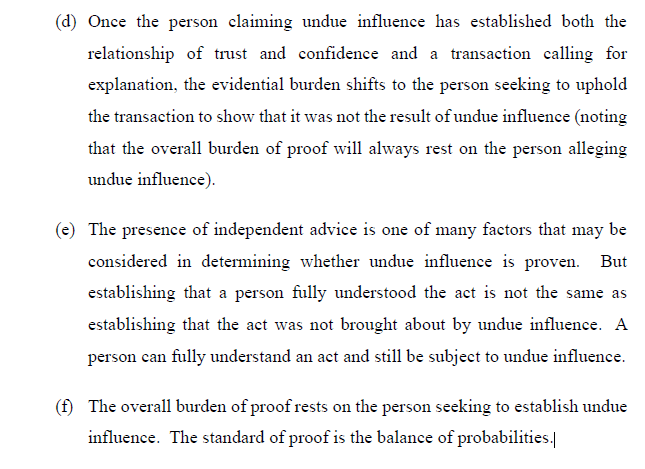

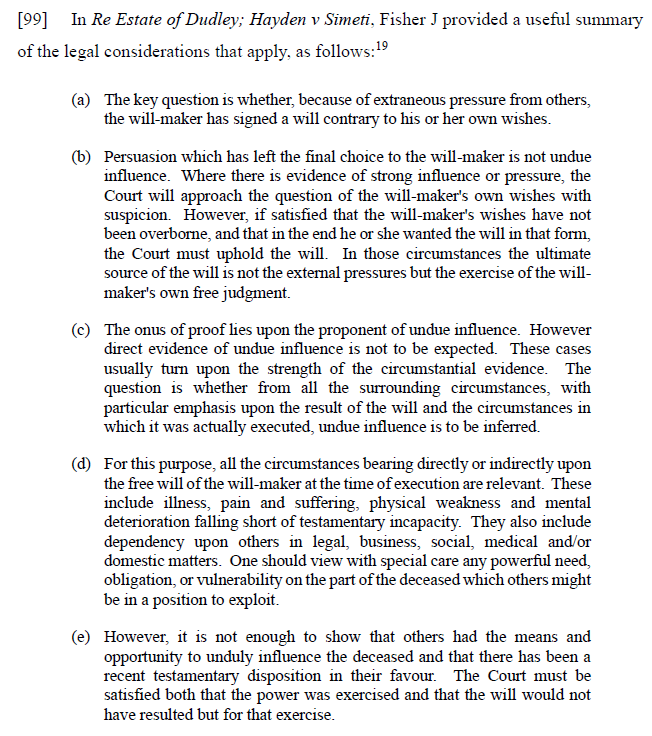

With respect to undue influence, it is helpful to set out the legal principles, which were summarised as follows at [87]:

There is no presumption of undue influence simply because a parent benefits one child rather another. However, as noted at [88]:

“… it may exist in “the relationship between a son in the prime of life and parents in the evening of life”.The relationship between Enid and Darryl in October 2014 was clearly one of trust and confidence, especially considering Enid’s age and her emotional reliance upon Darryl. I am satisfied that a rebuttable presumption has been created, the effect of which is that I can find that Darryl had influence over Enid. That being the case, Karen must establish that the transactions complained about call for an explanation.”

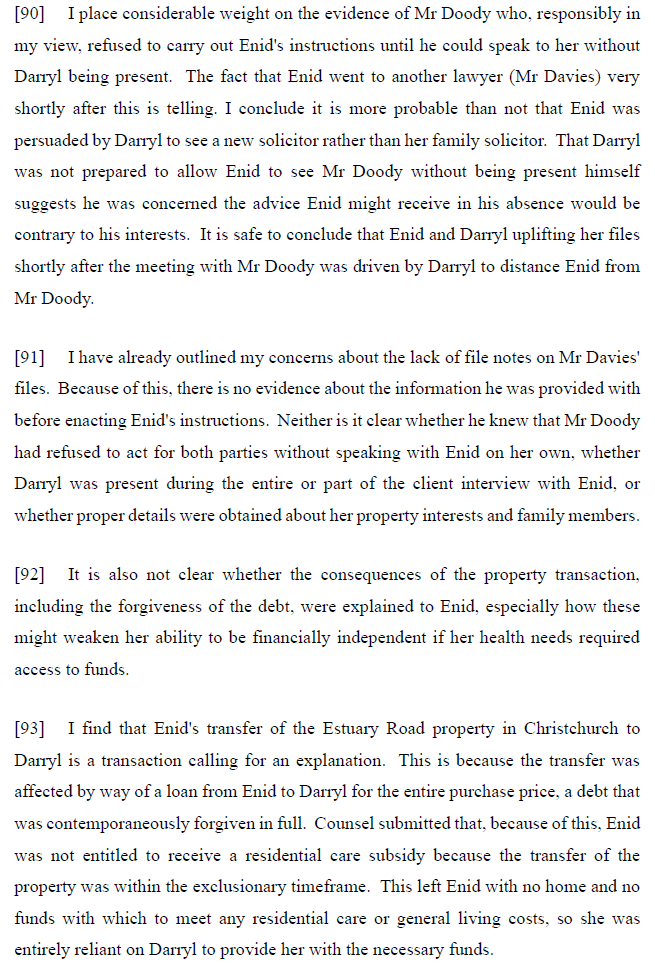

The Court placed considerable weight on the evidence of Enid’s former lawyer who refused to act on Enid’s instructiosn. As set out at [90] to [93]:

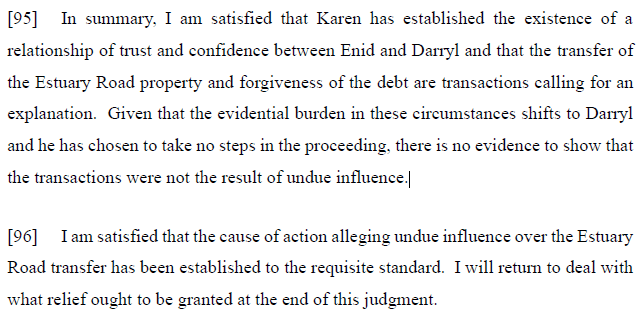

No explanation was given for why Enid might need to transfer her home since 1948 to her son. As then set out at [95] and [96]:

Although the transaction involving Enid’s home was found to be on account of undue influence, this does not automatically invalidate the will made at the same time. As set out at [97] to [ ]:

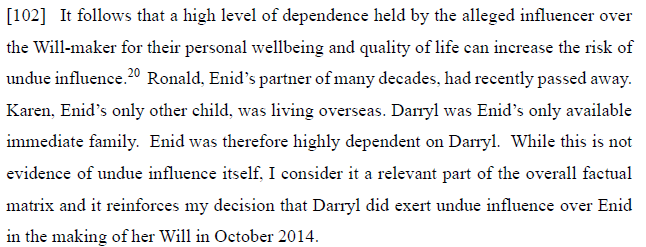

The family dynamic that confronted Enid was an important facet of the court’s determination that her will was invalid by reason of undue influenced, as well as incapacity:

The transaction involving Enid’s house was also unconsionable. As set out at [105] to [108]:

Finding unconscionable dealing and undue influence (and that Enid’s will was invalid], the question for the court was the appropriate remedy. As set out at [122]:

“Strictly speaking, Enid was paid for her house – she (on paper) lent the purchase price to Darryl. The evidence does not tell me whether the sale price was at an undervalue or not. However, the value of the loan, which in Enid’s hands replaced the value of her home, was immediately lost to her by virtue of the deed of forgiveness of debt. It is the forgiveness of debt that I therefore set aside…”

For wider capacity considerations see https://journal.step.org/step-journal-issue-5-2025/mental-capacity/step-expert-forum-trusts-and-loss-capacity .

References

- Hooper v Thackwell [2025] NZHC 648

- Hooper v Thackwell [2024] NZHC 2398

- Family Protection Act 1955, s 9

- Gaitz v Donovan (as executors of estate of Gaitz) [2022] NZHC 2107.

- Limitation Act 2010

- Round v Round [2017] NZHC 428

Discussion

No comments yet.