The Taxation (Annual Rates for 2023-24, Multinational Tax, and Remedial Matters) Bill (the Bill) has been amended by the inclusion of:

- an amended section HC B allowing three years from the year of the date of death before the 39% rate will apply to deceased estates

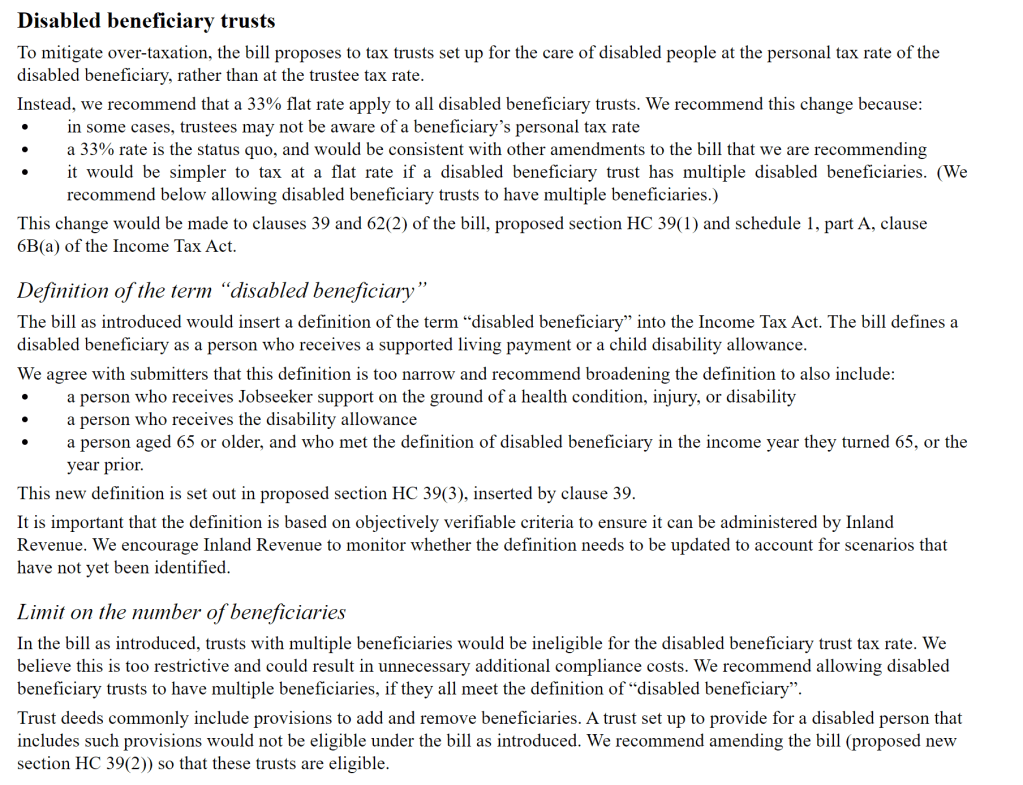

- an amended HC 39 to provide that trusts settled for disabled beneficiaries (as defined) will continue to be taxed at the 33% rate, and

- a new HC 40 to include a de minimis threshold of $10,000 before the proposed new 39% tax rate will apply.

As noted in the commentary to the Bill:

References:

Discussion

No comments yet.